Largest U.S. Grid Supplier Issues Dire Warnings About Nation’s Electricity

Comments by Brian Shilhavy

Editor, Health Impact News

The United States appears to be heading into major power grid failures as coal plants are shuttered while electricity consumption continues to climb to produce enough electricity to power electrical vehicles, and the explosion of data centers needed to run AI and increasing computing power.

Largest US Grid Supplier Warns of an Energy Shortage Due to Undeliverable Mandates

Let’s discuss the warnings of PJM Interconnect, the operator of the nation’s largest competitive market for electricity.

by Mishtalk.com

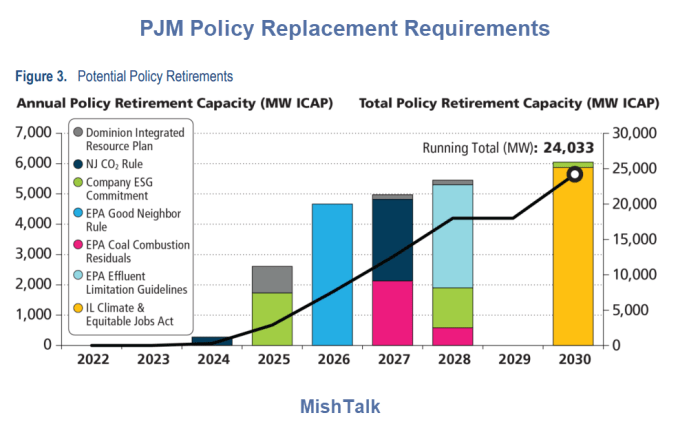

Before reviewing the PJM Interconnect February 2023 report, let’s take a look at policies and regulations.

Policies and Regulations

- EPA Coal Combustion Residuals (CCR): The U.S. Environmental Protection Agency (EPA) promulgated national minimum criteria for existing and new coal combustion residuals (CCR) landfills and existing and new CCR surface impoundments. This led to a number of facilities, approximately 2,700 MW in capacity, indicating their intent to comply with the rule by ceasing coal-firing operations, which is reflected in this study.

- EPA Effluent Limitation Guidelines (ELG): The EPA updated these guidelines in 2020, which triggered the announcement by Keystone and Conemaugh facilities (about 3,400 MW) to retire their coal units by the end of 2028. 14 Importantly, but not included in this study, the EPA is planning to propose a rule to strengthen and possibly broaden the guidelines applicable to waste (in particular water) discharges from steam electric generating units. The EPA is expecting this to impact coal units by potentially requiring investments when plants renew their discharge permits, and extending the time that plants can operate if they agree to a retirement date.

- EPA Good Neighbor Rule (GNR): This proposal requires units in certain states to meet stringent limits on emissions of nitrogen oxides (NOx), which, for certain units, will require investment in selective catalytic reduction to reduce NOx. For purposes of this study, it is assumed that unit owners will not make that investment and will retire approximately 4,400 MW of units instead. Please note that the EPA plans on finalizing the GNR in March, which may necessitate reevaluation of this assumption.

- Illinois Climate & Equitable Jobs Act (CEJA): CEJA mandates the scheduled phase-out of coal and natural gas generation by specified target dates: January 2030, 2035, 2040 and 2045. To understand CEJA criteria impacts and establish the timing of affected generation units’ expected deactivation, PJM analyzed each generating unit’s publicly available emissions data, published heat rate, and proximity to Illinois environmental justice communities and Restore, Reinvest, Renew (R3) zones. For this study, PJM focuses on the approximately 5,800 MW expected to retire in 2030.

Solar Projects On Hold

Next, consider the Inside Climate News report The Largest U.S. Grid Operator Puts 1,200 Mostly Solar Projects on Hold for Two Years

The nation’s largest electrical grid operator has approved a new process for adding power plants to the sprawling transmission system it manages, including a two-year pause on reviewing and potentially approving some 1,200 projects, mostly solar power, that are part of a controversial backlog.

Over the last four years, PJM officials have said they have experienced a fundamental shift in the number and type of energy projects seeking to be added to a grid, each needing careful study to ensure reliability. It used to be that PJM would see fewer, but larger, fossil fuel proposals. Now, they are seeing a larger number of smaller, largely renewable energy projects.

A new approval process will put projects that are the readiest for construction at the front of the line, and discourage those that might be more speculative or that have not secured all their financing.

Then, an interim period will put a two-year delay on about 1,250 projects in their queue—close to half of the total—and defer the review of new projects until the fourth quarter of 2025, with final decisions on those coming as late as the end of 2027.

Energy Transition in PJM

Now let’s now take a look at Energy Transition in PJM: Resource Retirements, Replacements & Risks released February 24, 2023.

Our research highlights four trends below that we believe, in combination, present increasing reliability risks during the transition, due to a potential timing mismatch between resource retirements, load growth and the pace of new generation entry under a possible “low new entry” scenario:

The growth rate of electricity demand is likely to continue to increase from electrification coupled with the proliferation of high-demand data centers in the region. Retirements are at risk of outpacing the construction of new resources, due to a combination of industry forces, including siting and supply chain, whose long-term impacts are not fully known. PJM’s interconnection queue is composed primarily of intermittent and limited-duration resources. Given the operating characteristics of these resources, we need multiple megawatts of these resources to replace 1 MW of thermal generation.

The analysis shows that 40 GW of existing generation are at risk of retirement by 2030. This figure is composed of: 6 GW of 2022 deactivations, 6 GW of announced retirements, 25 GW of potential policy-driven retirements and 3 GW of potential economic retirements. Combined, this represents 21% of PJM’s current installed capacity.

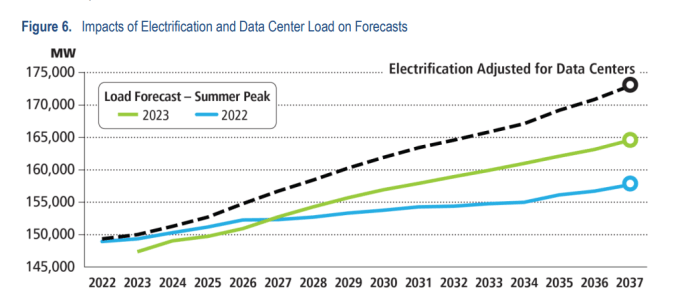

In addition to the retirements, PJM’s long-term load forecast shows demand growth of 1.4% per year for the PJM footprint over the next 10 years. Due to the expansion of highly concentrated clusters of data centers, combined with overall electrification, certain individual zones exhibit more significant demand growth – as high as 7% annually.

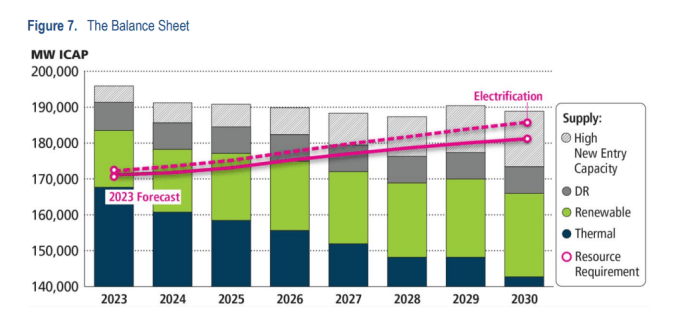

For the first time in recent history, PJM could face decreasing reserve margins should these trends continue. The amount of generation retirements appears to be more certain than the timely arrival of replacement generation resources and demand response, given that the quantity of retirements is codified in various policy objectives, while the impacts to the pace of new entry of the Inflation Reduction Act, post-pandemic supply chain issues, and other externalities are still not fully understood.

Recent movement in the natural gas spot markets across the U.S. and Europe add another degree of uncertainty to future operations. In 2022, European natural gas supply faced many challenges resulting from the war in Ukraine and subsequent sanctions against Russia. Liquefied natural gas (LNG) imports into the EU and the U.K. in the first half of 2022 increased 66% over the 2021 annual average, primarily from U.S. exporters with operational flexibility. This international natural gas demand is a new competitor for domestic spot-market consumers, resulting in significantly higher fuel costs for PJM’s natural gas fleet.

Along with the energy transition, PJM is witnessing a large growth in data center activity. Importantly, the PJM footprint is home to Data Center Alley in Loudoun County, Virginia, the largest concentration of data centers in the world. PJM uses the Load Analysis Subcommittee (LAS) to perform technical analysis to coordinate information related to the forecast of electrical peak demand. In 2022, the LAS began a review of data center load growth and identified growth rates over 300% in some instances.

Additionally, PJM is expecting an increase in electrification resulting from state and federal policies and regulations. The study therefore incorporates an electrification scenario in the load forecast to provide insight on capacity need should accelerated electrification drive demand increases.

Impacts of Electrification and Data Center Loads

What Does This Mean for Resource Adequacy in PJM?

Combining the resource exit, entry and increases in demand, summarized in Figure 7, the study identified some areas of concern. Approximately 40 GW PJM’s fossil fuel fleet resources may be pressured to retire as load grows into the 2026/2027 Delivery Year.

The projected total capacity from generating resources would not meet projected peak loads, thus requiring the deployment of demand response. By the 2028/2029 Delivery Year and beyond, at Low New Entry scenario levels, projected reserve margins would be 8%, as projected demand response may be insufficient to cover peak demand expectations, unless new entry progresses at a levels exhibited in the High New Entry scenario. This will require the ability to maintain needed existing resources, as well as quickly incentivize and integrate new entry

The 2024/2025 BRA, which executed in December 2022, highlighted another area of uncertainty. Queue capacity with approved ISAs/WMPAs is currently very high, approximately 35 GW-nameplate, but resources are not progressing into construction.

There has only been about 10 GW-nameplate moving to in service in the past three years. There may still be risks to new entry, such as semiconductor supply chain disruptions or pipeline supply restrictions, which are preventing construction despite resources successfully navigating the queue process.

About that Queue

After applying the logistical regression model for 10 years of historical project completion (Y-queue to present) without project stage, approximately 15.3 GW-nameplate/8.7 GW-capacity were deemed commercially probable out of 178 GW of projects examined.

The model results for thermal resources were reasonably in line with expectations. However, the model produced extremely low entry from onshore wind, offshore wind, solar, solar-hybrid and storage resources.

Key Points

Only 15.3 GW out of 178 GW examined were deemed commercially probable.

“The model produced extremely low entry from onshore wind, offshore wind, solar, solar-hybrid and storage resources. ”

There are thousands in the queue to evaluate.

Thank you Inflation reduction act.

Mish Synopsis

- Expect to pay much higher prices for electricity

- Expect brownouts

- Expect missed targets

- Expect most of the thousands of project requests on hold to be economically unviable.

- Expect many economically unviable projects to continue anyway paid for by taxpayer subsidies.

- Expect much higher inflation.

- Don’t expect any of this to do a damn thing for the environment.

Question of the Day – How Fast Will the Shift to EVs happen?

In case you missed it, please consider Question of the Day – How Fast Will the Shift to EVs happen?

The faster the shift, the higher and faster the inflation.

Read the full article at Mishtalk.com.

Comment on this article at HealthImpactNews.com.

See Also:

Understand the Times We are Currently Living Through

Synagogue of Satan: Why It’s Time to Leave the Corporate Christian Church

Spiritual Wisdom vs. Natural Knowledge – Why There is so Much Deception Today

How to Determine if you are a Disciple of Jesus Christ or Not

Epigenetics Exposes Darwinian Biology as a Religion – Your DNA Does NOT Determine Your Health!

Year 2023: Will America Fulfill Its Destiny? Jesus Christ is the Only “Transhuman” the World Has Ever Seen or Will Ever See

What Happens When a Holy and Righteous God Gets Angry? Lessons from History and the Prophet Jeremiah

The Most Important Truth about the Coming “New World Order” Almost Nobody is Discussing

Insider Exposes Freemasonry as the World’s Oldest Secret Religion and the Luciferian Plans for The New World Order

Identifying the Luciferian Globalists Implementing the New World Order – Who are the “Jews”?

Fact Check: “Christianity” and the Christian Religion is NOT Found in the Bible – The Person Jesus Christ Is

The Seal and Mark of God is Far More Important than the “Mark of the Beast” – Are You Prepared for What’s Coming?

The Satanic Roots to Modern Medicine – The Mark of the Beast?

Medicine: Idolatry in the Twenty First Century – 7-Year-Old Article More Relevant Today than the Day it was Written

Having problems receiving our newsletters? See:

How to Beat Internet Censorship and Create Your Own Newsfeed

We Are Now on Telegram. Video channels at Bitchute, and Odysee.

If our website is seized and shut down, find us on Telegram, as well as Bitchute and Odysee for further instructions about where to find us.

If you use the TOR Onion browser, here are the links and corresponding URLs to use in the TOR browser to find us on the Dark Web: Health Impact News, Vaccine Impact, Medical Kidnap, Created4Health, CoconutOil.com.

The post Largest U.S. Grid Supplier Issues Dire Warnings About Nation’s Electricity first appeared on Vaccine Impact.