The Flood Begins: Treasury To Sell Over A Quarter Trillion Bills In 48 Hours

The Flood Begins: Treasury To Sell Over A Quarter Trillion Bills In 48 Hours

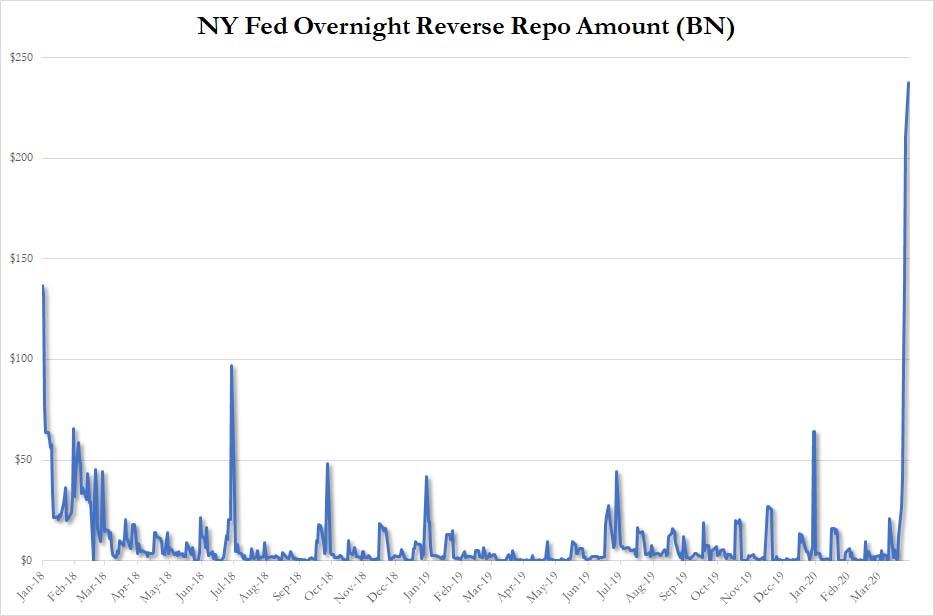

Having noticed the Treasury shortage forming in the bond market, which as we observed emerged both across the broader curve as manifested by the surging demand for the Fed’s reverse repo…

… as well as the unprecedented demand for “cash-like” T-Bills resulting in negative yields for all paper through 3 months…

… which has gifted bond traders with an arb that literally prints free money as described in “Here Is The Treasury’s (Not So) Secret Trade Printing Millions In Guaranteed, Risk-Free Profits Every Day“, the Treasury has taken decisive action and in order to prevent the Fed from becoming the money market fund of last resort, is literally flooding the market with T-Bills to satisfy the market’s panicked need for cash-equivalent paper by announcing an additional two cash management bills today in addition to the one that was revealed last week.

Starting tomorrow, the Treasury will sell just over $100 billion in Cash Management Bill, including a $60BN 42-day CMB and a $45BN 69-day security at 11:30am ET on Tuesday. This follows the sale of $60BN of 37-day CMBs at 0.025% Monday, which saw Indirects awarded 60.6% of the issue.

There’s more: the Treasury also sold $51BN of three-month bills at 0.085% (tailing the When-issued bid of 0.040%), and $42BN of six-month Bills which also tailed at 0.100% versus the WI bid of 0.085%. Why the tails? According to Jefferies economists Thomas Simons and Ward McCarthy, the morning announcement of a second $60BN CMB auction this week, plus quarter-end balance sheet pressure “necessitated some concession for the auctions.” Also, while the 4.5bps tail can be considered a bad thing, the market is “just starting to back off zero or negative yields” so the auctions are still coming in at “very, very low outright yield levels” according to the Jefferies duo.

In other words, inside of 48 hours we are looking at a gross deluge of $258BN gross in Bills and Cash Management Bills to satisfy what seems to be unprecedented demand for short-term paper. On a net basis, between Monday’s regularly schedule auctions, Tuesday’s four- and eight- week settlements and cash management bill sales, the Treasury will raise about $194BN of new cash this week, according to Bloomberg calculations.

And that’s just the beginning, as the Treasury does everything it can to alleviate the Treasury shortage. Considering it has a few trillion in stimulus payments it has to fund, we are confident the shortage won’t last too long.

Tyler Durden

Mon, 03/30/2020 – 19:05![]() Original source: http://feedproxy.google.com/~r/zerohedge/feed/~3/mour1CIV66Q/flood-begins-treasury-sell-over-quarter-trillion-bills-48-hours

Original source: http://feedproxy.google.com/~r/zerohedge/feed/~3/mour1CIV66Q/flood-begins-treasury-sell-over-quarter-trillion-bills-48-hours